Integrated Business Planning: From Chaos to Symphony

- Julien Brun

- Jun 5, 2025

- 8 min read

Updated: Jun 6, 2025

Quick Takeaways

IBP transforms fragmented planning: Integrated business planning unifies strategic, operational, and financial planning across all departments to eliminate silos and improve decision-making speed

Dramatic ROI potential: McKinsey research shows mature IBP practitioners achieve 1-2 additional percentage points in EBIT, with 5-20% higher service levels and 10-15% lower freight costs

Beyond S&OP scope: IBP extends traditional sales and operations planning by incorporating financial data, market insights, and strategic goals into a comprehensive planning framework

Risk management focus: IBP uses scenario planning and predictive analytics to help organizations respond 60% faster to market disruptions compared to fragmented planning approaches, enabling the kind of resilient supply chain strategies that modern businesses require

Financial-operational integration: Dynamic cost allocation reveals true product and customer profitability, enabling portfolio decisions based on actual resource consumption rather than averaged costs

Your CFO storms into Monday's executive meeting with three different revenue forecasts. Sales projects 15% growth, Supply Chain warns of capacity constraints, and Finance shows a cash flow crisis by Q3. Each department plays their own tune, yet nobody can explain why the numbers don't align.

The Cacophony of Fragmented Planning

Most companies operate like an orchestra without a conductor - each section playing beautifully in isolation while creating chaos together. The violins of Sales soar with optimistic projections, the brass of Operations pounds out capacity warnings, and the percussion of Finance keeps an entirely different beat. The result? Discordant planning that drowns out strategic clarity.

This scenario plays out in boardrooms worldwide because 98% of companies still rely on spreadsheets for critical planning processes, according to Board International's 2023 Global Planning Survey. Meanwhile, their 2024 research reveals that while 78% of organizations believe their planning transformation attempts were successful, only 16% achieved truly effective planning systems - exposing a massive gap between intention and execution.

The financial impact is staggering. Companies with fragmented planning processes experience:

40% longer planning cycles

25% higher inventory holding costs

30% more forecast errors

60% more time spent on data reconciliation versus strategic analysis

The Three Fundamental Disconnects

Strategic-Operational Discord: Your five-year strategy sounds magnificent in the boardroom, but operations can't execute what they can't coordinate. Consider a global pharmaceutical company that launched a $50M market expansion, only to discover their supply chain couldn't support the projected volumes. Marketing had committed to launch dates based on sales projections, while manufacturing was still validating production capacity. The result? A six-month delay that cost market share to competitors.

This pattern repeats across industries. Marketing launches promotions without checking inventory levels. Sales commits to delivery dates that manufacturing can't meet. Product development promises features that supply chains can't source. Each function optimizes its own performance while business objectives suffer.

Data Cacophony: Like musicians reading different sheet music, your teams work from incompatible data sources. Finance uses last quarter's actuals, Sales relies on pipeline projections, and Supply Chain operates from safety stock assumptions. A recent study found that executive teams spend 40% of planning meetings reconciling conflicting data rather than making strategic decisions.

One consumer goods company discovered they had 47 different versions of "demand forecast" across their organization. Sales used CRM data, Marketing relied on campaign analytics, Finance worked from budget assumptions, and Supply Chain operated from historical consumption patterns. Each data set was accurate within its context, but collectively they created planning paralysis.

Cost Allocation Blindness: Traditional planning treats fixed costs like background noise - spread evenly across products regardless of actual consumption. This creates dangerous illusions about profitability. You might think Product A generates 20% margins when it actually operates at break-even, while Product B appears marginal when it drives 35% profitability.

A manufacturing company recently discovered their "star product" was actually unprofitable once they allocated costs based on actual resource consumption. The product required frequent changeovers, specialized quality testing, and expedited shipping - costs that were previously spread equally across all products. Meanwhile, their "low-margin" commodity products were actually profit engines because they utilized capacity efficiently.

The Hidden Costs of Planning Dysfunction

Beyond obvious inefficiencies, fragmented planning creates three hidden costs that erode competitive advantage:

Decision Paralysis: When every function presents different versions of truth, executives delay critical decisions while seeking consensus. A technology company we studied spent four months debating capacity expansion because Sales projected 30% growth, Operations forecasted flat demand, and Finance modeled 15% decline. By the time they reached agreement, market conditions had shifted entirely.

Suboptimization Epidemic: Each function maximizes its own metrics at the expense of business outcomes. Sales pushes high-margin products without considering manufacturing complexity. Operations minimizes changeovers regardless of customer demand patterns. Finance cuts inventory to improve working capital while service levels plummet.

Innovation Paralysis: Complex planning processes stifle agility. New product launches require coordination across multiple planning cycles. Market opportunities expire while teams debate resource allocation. A consumer electronics company lost a $200M market opportunity because their planning process couldn't accommodate mid-cycle product introduction.

What True Integration Looks Like

Best-in-class companies have moved beyond functional planning to genuine business orchestration. Like a symphony conductor who sees the complete score, these organizations coordinate planning across all functions from a unified platform.

Unified Data Foundation

Instead of reconciling multiple data sources, integrated planning starts with a single version of truth. This doesn't mean one massive database, but rather connected systems that share consistent assumptions, definitions, and metrics. When demand changes, the impact cascades through supply planning, financial projections, and capacity requirements automatically.

Dynamic Cost Understanding

Rather than averaging fixed costs across products, advanced planning tracks actual resource consumption. This reveals how costs fluctuate based on throughput, timing, and complexity. A distribution center might show $0.40 per unit during low-volume periods and $0.13 during peak efficiency- insights that transform pricing and portfolio decisions.

Scenario-Driven Planning

Instead of creating one "base case" plan, integrated planning evaluates multiple scenarios simultaneously. What happens if demand spikes 20%? How does a supplier disruption cascade through the network? What's the financial impact of accelerating a product launch? These scenarios inform contingency planning and reveal hidden interdependencies.

Real-Time Course Correction

Like GPS recalculating routes based on traffic conditions, integrated planning adjusts continuously as conditions change. Rather than waiting for monthly planning cycles, teams can model impacts and adjust plans as new information emerges.

What is Integrated Business Planning (IBP)?

Integrated Business Planning (IBP) is a holistic management process that unifies strategic planning, operational planning, and financial planning within an organization. Unlike traditional planning approaches that operate in functional silos, IBP brings together sales, marketing, finance, supply chain, and operations teams to collaborate on decisions that drive overall business success.

According to Oliver Wight, the consulting firm that originated IBP methodology, the process functions as "a decision-making process to align strategy, portfolio, demand, supply, and resulting financials through a focused and exception-driven monthly re-planning process that results in a single operating plan over a 24+ month rolling horizon." The firm further explains that IBP enables "organizations take a holistic view of their operations" and goes beyond simple functional coordination - "it's not about just coordinating every function around a well-defined strategy. It also helps management plan for agility by having visibility into operations; and stay true to clear, value-enhancing objectives over longer horizons."

Core Characteristics

IBP represents what industry experts call "one generation beyond sales and operations planning" by incorporating:

Cross-functional Integration: Unifies sales, marketing, finance, supply chain, operations, and strategic planning functions

Strategic-Operational Alignment: Connects long-term strategic objectives with near-term operational capabilities

Financial Synchronization: Integrates operational plans with financial projections in real-time

Scenario-Based Planning: Enables modeling of multiple business scenarios and their impacts

Rolling Planning Horizon: Maintains continuous 18-36 month forward visibility with regular updates

IBP transforms planning from a collection of departmental activities into what practitioners describe as "thinking about an organization as a single entity" rather than disparate functions working independently.

How IBP Transforms Business Performance

McKinsey's comprehensive study of 170+ companies over five years reveals dramatic improvements from mature IBP implementations:

1-2 additional percentage points in EBITDA

5-20 percentage points higher service levels

10-15% lower freight costs and capital intensity

40-50% lower customer delivery penalties and missed sales

10-20% more productive planners

Moreover, companies that successfully integrate planning report dramatic improvements across multiple dimensions:

Speed to Decision: Monthly planning cycles shrink from weeks to days. A pharmaceutical company reduced their S&OP process from 15 days to 2 days while improving forecast accuracy from 65% to 89%. The time savings freed analysts for strategic work rather than data manipulation.

Profit Visibility: Dynamic cost allocation reveals profitable opportunities previously hidden by averaged allocations. A consumer healthcare company identified $15M in profit optimization by understanding true cost-to-serve dynamics across their product portfolio.

Agile Response: When external shocks occur - pandemic disruptions, supply shortages, demand spikes - integrated planning enables rapid recalculation and response. Companies with unified planning responded to COVID-19 disruptions 60% faster than those with fragmented processes.

Cross-Functional Alignment: Perhaps most importantly, integrated planning eliminates the "waterfall effect" where Sales makes commitments that Operations can't fulfill. Teams work from shared understanding of constraints and opportunities.

Real-World Success Stories

Global Food Manufacturer: Previously, brand managers created promotion plans without understanding manufacturing implications, resulting in constant firefighting - overtime costs, expedited shipping, and stockouts. After implementing integrated business planning, promotion planning became collaborative. Brand managers could see manufacturing constraints, Operations understood marketing timelines, and Finance could model profit impacts before committing. Result: 25% reduction in total supply chain costs and 40% improvement in service levels.

Specialty Chemicals Company: Their cost accounting system allocated overhead based on direct labor hours - meaningless in their automated facility. Products appeared profitable or unprofitable based on accounting artifacts rather than economic reality. Integrated planning with dynamic cost allocation revealed true profitability drivers: asset utilization, changeover frequency, and quality requirements. This led to portfolio rationalization improving overall margins by 18% while reducing complexity.

Implementation Realities

The journey from fragmented to integrated planning isn't without challenges. Success requires addressing three critical dimensions:

Executive Commitment: Integration requires sustained leadership support through inevitable implementation challenges. Half-hearted efforts produce half-hearted results.

Pilot Approach: Rather than transforming everything simultaneously, successful companies start with one product line or business unit. This allows learning and refinement before broader rollout.

User-Centric Design: The most sophisticated planning logic fails if users can't or won't engage with it. Success requires tools that real humans want to use, not just technical specialists.

Continuous Improvement: Integrated planning isn't a destination but a capability that improves over time. Companies must invest in ongoing refinement and optimization.

Moving from Chaos to Symphony

The companies winning in today's volatile markets aren't necessarily the smartest or best-resourced - they're the most harmonized. They've moved beyond spreadsheet-based planning to integrated business orchestration where every function contributes to unified performance.

Integrated Business Planning represents more than a process upgrade - it's a fundamental transformation from functional excellence to business symphony. The evidence is compelling: McKinsey's research shows mature IBP practitioners achieve significant competitive advantages including 1-2 percentage points EBITDA improvement, 5-20% higher service levels, and 40-50% fewer delivery penalties.

This transformation requires sustained commitment across three dimensions: technology integration that connects rather than replaces existing systems, process redesign that enables collaborative decision-making, and organizational alignment that rewards business optimization over functional performance.

The path forward starts with honest assessment of current planning maturity, clear vision of desired future state, and commitment to sustained transformation effort. Companies that successfully make this journey don't just improve their planning - they transform their competitive position for the digital economy ahead.

Ready to transform your planning from chaos to symphony?

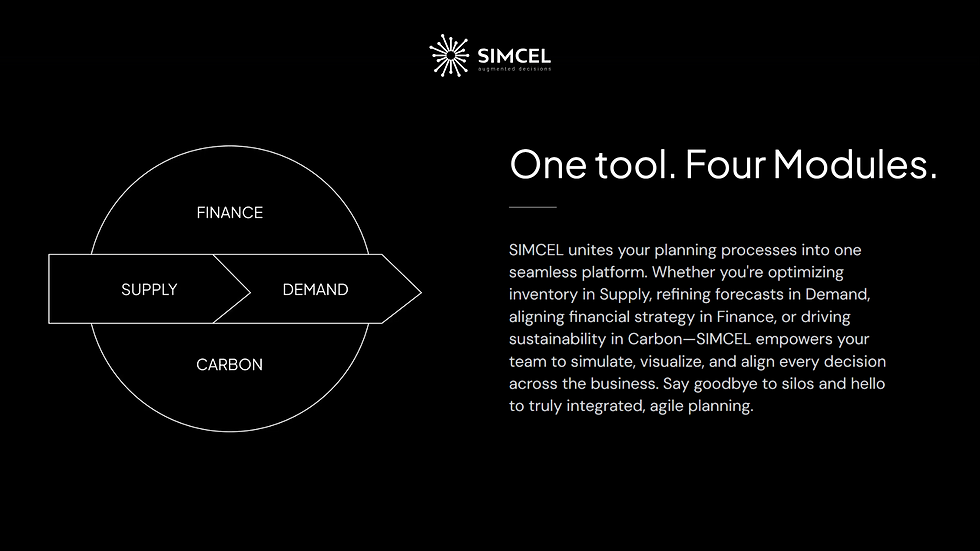

Modern IBP solutions like SIMCEL create harmony between strategy and execution through digital twin technology that real humans can use. These platforms unify demand, supply, finance, and sustainability planning into one orchestrated process, delivering enterprise planning precision with the usability your teams actually want.

Build Resilient Supply Chains with Dynamic Simulation → Integrate Sustainability into Business Planning →

References

McKinsey & Company. (2022). "The transformative power of integrated business planning." Retrieved from https://www.mckinsey.com/capabilities/operations/our-insights/a-better-way-to-drive-your-business

IBM. (2025). "What is Integrated Business Planning (IBP)?" Retrieved from https://www.ibm.com/think/topics/integrated-business-planning

Board International. (2023). "Global Planning Survey Enterprise Planning." Retrieved from https://www.board.com/news/board-international-announces-results-its-global-planning-survey-enterprise-planning

SAP. (2024). "SAP IBP | Integrated Business Planning Software for Supply Chain." Retrieved from https://www.sap.com/products/scm/integrated-business-planning.html

OneStream Software. (2024). "What Is Integrated Business Planning (IBP)? A Complete Guide." Retrieved from https://www.onestream.com/blog/complete-guide-to-integrated-business-planning-ibp/

interesting comparison between an orchestra and an IBP process. In IBP even through there are less "musicians" is seems more complicated to play in sync ;-)

I'm curious how do you maintain local market flexibility while achieving this 'unified planning'?

Some of our emerging markets require very different approaches

The orchestra analogy is perfect!

Very inspiring